Bank of Canada Monetary Policy

The following statistics were released from the Economics and Statistics Division on October 23, 2024. For full details from this dataset, please click here.

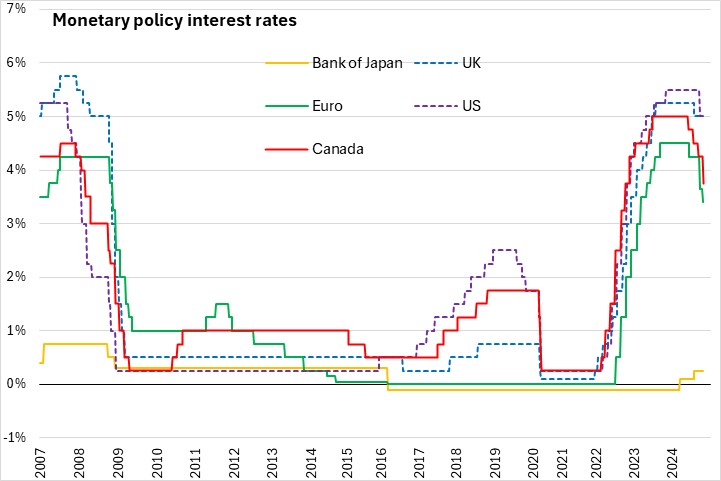

- The Bank of Canada reduced its target for the overnight rate by 50 basis points to 3.75%, with the Bank rate reduced to 4.0% and the deposit rate down to 3.75%

- Canada’s economy grew by 2% in the first half of 2024 and the Bank expects a slightly slower pace for the rest of the year

- Although energy exports have boosted growth with the completion of the Trans Mountain Expansion pipeline, labour markets and residential construction activity remain soft nationally

- Despite persistent excess supply, wage growth has outpaced productivity growth

- Newcomers to Canada as well as younger workers have borne a disproportionate share of labour market weakness

- In the Bank’s revised economic outlook, gradual strengthening of the Canadian economy is expected after reductions in interest rates

- Canada’s real GDP growth is projected to accelerate from 1.2% in 2024 to 2.1% in 2025 and 2.3% in 2026

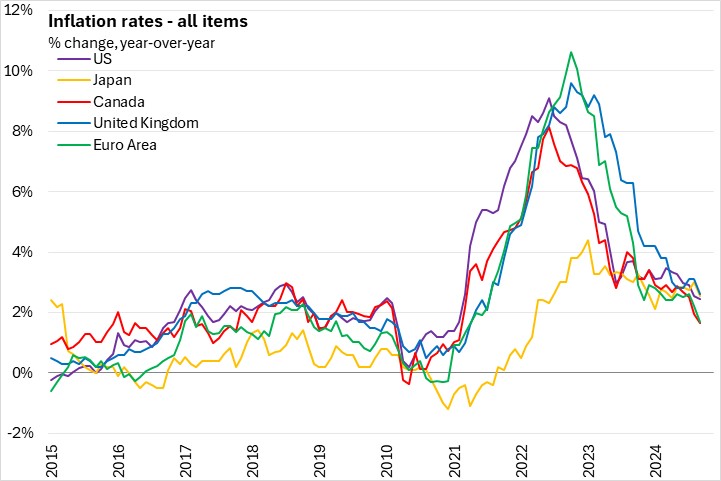

- Although all-tems inflation has slowed to 1.6% as of September, shelter cost price growth remains elevated

- The Bank of Canada’s core measures of inflation have also slowed to <2.5%

The next scheduled date for announcing the overnight rate is December 11, 2024.